Professional. Personal. Proudly Beloit.

Legacy Tax has been helping families and small businesses across Beloit and Southern Wisconsin maximize refunds, simplify payroll, and plan for the future — with a friendly, women-led approach.

About Us

Empowering Financial Growth & Stability

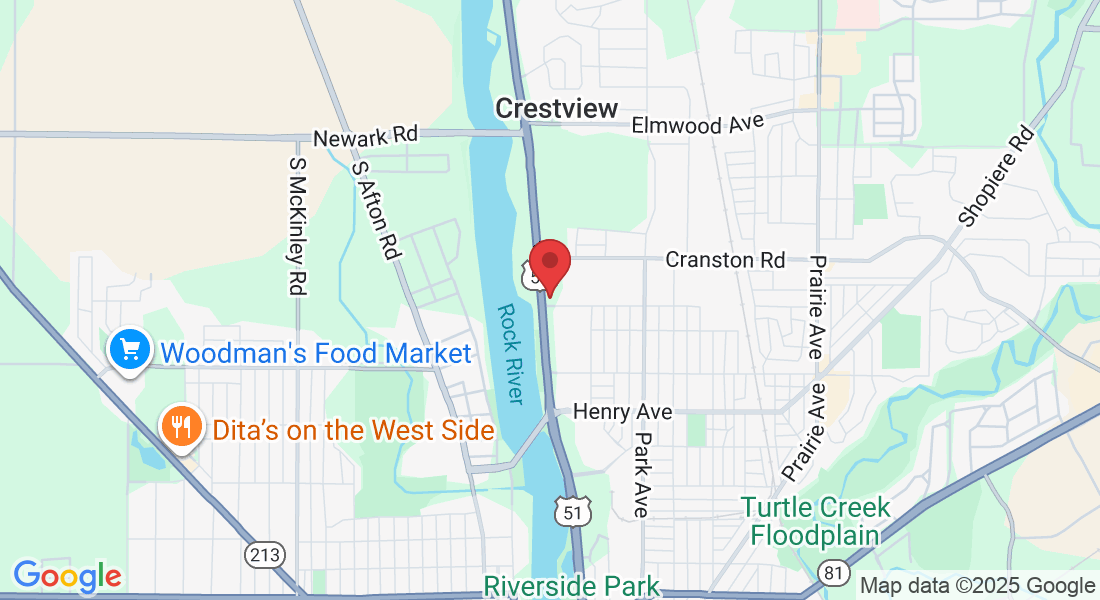

Located in Beloit, Legacy Tax is a women-led team of tax professionals focused on being approachable, reliable, and rooted in our community. Our advisors combine professional credentials with a friendly approach — we explain numbers plainly and work with you to plan for the next chapter.

20+

Years of Experience

100's

of Happy Clients

5+

Years in Beloit

1000's

of Questions Ansewered

Our Services

Innovative Solutions for

Modern Accounting

- Practical, clear advice — no jargon.

- Local knowledge of Beloit's small business and family needs.

- Friendly, women-led service with strong credentials.

Tax Preparation

Individual and business tax return preparation, filing, and optimization — done carefully to maximize refunds and minimize liability.

Accounting

Bookkeeping, financial statements, and ongoing accounting support to keep your business organized and audit-ready.

Payroll

Payroll processing, payroll tax filings. — reliable, accurate, and timely.

Retirement Planning

Guidance on IRAs, 401(k) options, and tax-smart withdrawal strategies to protect your retirement savings.

New Business Formation

Entity selection, registration, EIN application support, and tax planning for startups and new small businesses.

Audit Assistance

Support if your return is selected for audit — document gathering, communication, and professional representation.

Our Process

Our Roadmap to Financial Excellence

Assessment & Analysis

Planning & Implementation

Monitoring & Adjustment

02

Assessment & Analysis

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is distribution of letters.

01

Planning & Implementation

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is distribution of letters.

03

Monitoring & Adjustment

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is distribution of letters.